Fundamentals

Driven with

Unique

Framework

in listed Indian equities. Abakkus is a professionally run asset manager with highly experienced and able team with endeavor to generate alpha by strict adherence to processes, frameworks and discipline.

To make Abakkus one of India’s most revered and top performing asset management firms over time.

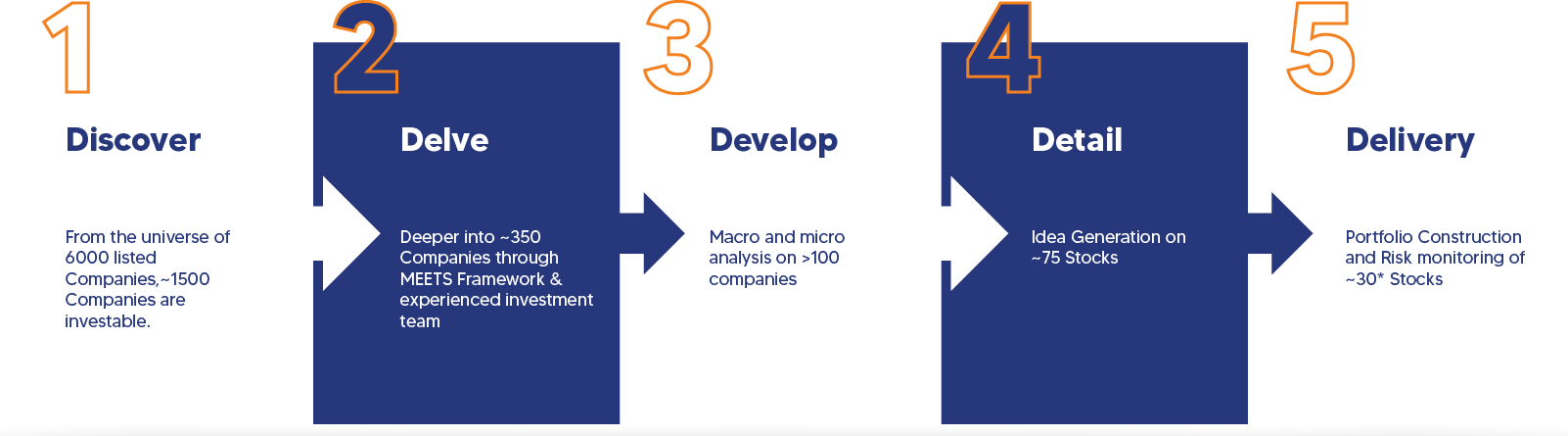

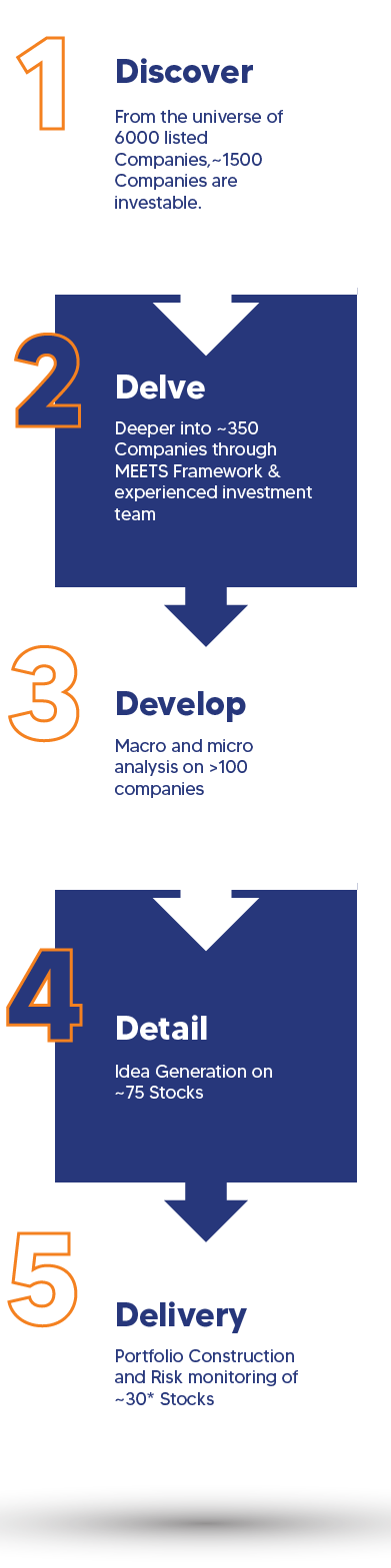

Abakkus follow the 5D Process for investment

Backed by a well-qualified dedicate team of professionals that have a cumulative experience of ~150 years

A well-established performance track records over 2 decades in public equity funds and across all market cycles

Follow a start-up culture with a high degree of commitment, urgency and passion

Focused investment in Alpha plays beyond the large number of listed companies supported by non-consensus, in-house research, and thoughts

Greater flexibility in investing into new sectors, new themes which are backed by entrepreneur driven economy

Investment team has delivered consistently across market cycle

Well Qualified team with cumulative experience of more than 200 years.

Greater flexibility in investing vis-à-vis mutual funds.

We believe in starting from basic with high degree of commitment, urgency and passion.

Alpha-focused strategy.

Focused team with a well-established track record.

We do not believe in –

- Chasing momentum

- Churning unnecessarily

- Copying and mimicking market

- Taking Credit Risk

Disclaimer: You acknowledge and confirm that by accessing the website, you are seeking information relating to the organisation of your own accord and that there has been no form of solicitation, advertisement or inducement by the organisation. Any part of the content is not, and should not be construed as, an offer or solicitation to buy or sell any securities or make any investments or any products. No material/information provided on this website should be construed as investment advice. Any action on your part on the basis of the said content is at your own risk and responsibility. For detailed disclaimer and terms and conditions click here.

CIN: AAM-2364 | PMS SEBI Reg. No.: INP000006457 | RIA SEBI Reg. No.: INA000015729 |

Category III AIF SEBI Reg. No.: IN/AIF3/18-19/0550

Category II AIF SEBI Reg. No.: IN/AIF2/21-22/0980 | Category I AIF SEBI Reg. No.: IN/AIF1/21-22/0976 | Category III AIF (Open Ended) SEBI Reg. No.: IN/AIF3/23-24/1326 | Registered FME (Non-Retail) IFSCA Reg. No.: IFSCA/FME/II/2022-23/041

Abakkus Asset Manager LLP | All Rights Reserved